QuickBooks Payroll Service

QuickBooks Payroll Service: What Is It And How To Avail It?

As an accounting professional, you may be well aware of the intricacies of payroll management. We consider it because payroll management is a complex and time-consuming process. Here, going with an automated payroll managing tool can be a helping hand. So, considering this aspect, we are here with an excellent facility for your business- QuickBooks payroll service.

QuickBooks payroll is an exceptional facility to simplify your payroll processing. So, in this guide, we will discuss QB payroll service and its deployment mechanism. Besides, you can connect with QuickBooks Desktop payroll support for further assistance. Till then, you can start with the guide to learn more about payroll services.

What Is QuickBooks Payroll Service?

Tech player Intuit is popular for its outstanding accounting solutions and services. Among these, QB Payroll is a prevalent solution for businesses’ payroll-related tasks. You can handle payroll processes through this framework, including employee wages, taxes, and deductions. What’s more exciting is its automated module that saves time and minimizes the error percentage.

Paycheck Calculation

- Work hours

- Salary

- Overtime duty

- Leaves

- Taxes

Tax Handling

Desktop Payroll of QuickBooks automates the calculation and filing of federal and state payroll taxes. Moreover, it ensures compliance with tax laws and regulations.

Direct Deposit

Accountants prefer QB Payroll due to its direct deposit mechanism. This facility lets businesses transfer paychecks to employees’ accounts. In short, it brings quickness and convenience to payroll processing.

Generate Payroll Reports

The generation of accurate reports on payroll processing seems tricky for accountants. Thus, you can rely on QB Payroll to get insights into payroll expenses, taxes, and relevant financial information.

QB Integration

Being a 360-degree platform for accounting, QuickBooks supports easy integration of associated services. As per this, you can integrate QB Payroll with your desktop version to simplify and centralize the finance management structure.

What Are Different Plans Of QuickBooks Payroll?

In general, there are three different categories of QB Payroll plans:

Basic

- Paycheck creator

- Direct deposit facility (supports up to 1099 contractors’ and employees’ deposits)

- Time tracker

- Free expert support

Enhanced

- Provides real-time information to employees’ paychecks

- Delivers benefits of subscribed versions besides providing expert support

Assisted

- Supports up to 250 employees mark.

- Specialist assistance for payroll deployment.

- Job costing

- Class tracking

- On-time tax filing

- Penalty savior

How To Avail Payroll Services In QuickBooks?

Listed below are the steps to avail of payroll services in QuickBooks:

Step 1: Activation of Payroll Subscription

- First, submit the payroll service key.

- Next, activate the subscription.

Step 2: Submit the Online Application/ Create a Payroll PIN

- First, submit the officer’s information.

- Then, submit the online application.

Step 3: Arrange Your Payroll Tasks

- First, open the desired company file.

- Afterward, select “Employees”, and subsequently, hit the “Payroll Setup.”

- Next, add employees to the list.

- Then, set up these variables- pay items, deductions, taxes, and PTO.

- Now, submit the payment history.

- Lastly, review and finalize the submitted details.

Step 4: Activation Of Payroll Services And Signing Of Payroll Authorization Forms

After setting QB variables, contact QuickBooks Online Payroll support to get a review of your payroll setup. After that, the QB team will send authorization mail to the principal officer. The principal officer has to sign the mail and simultaneously revert to the QB team.

How To Fix QuickBooks Online Payroll Issues?

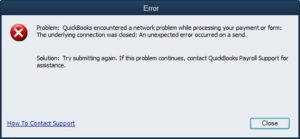

- QuickBooks Payroll not working

- QB Payroll connection error

- Network problem in QuickBooks Payroll

Fixing out these components requires many methods, which you can refer to in the following ways:

Method 1: Clear The Browser’s History And Cache

- To start with, open the system browser.

- Next, move to the “General” tab and click on the “Browsing History” option.

- Then, check “Temporary Internet Files” and “Internet Files.”

- After that, click on the “Delete” option and subsequently, hit the “OK” key.

- Lastly, try to send the system payroll.

Method 2: Flush The DNS Using The Command Prompt

- First, press the Windows+R keys to open the “Run” window.

- Next, in the dialogue box, type “CMD” and hit the “Enter” key.

- Furthermore, type “ipconfig or flushdns” in the appropriate section and hit the “OK” key.

- Finally, retry to send payroll.

Method 3: Exclude Revocation From IE Browser

- First, move to the “Tools” section in Internet Explorer.

- Then, opt for “Internet Options” and select the “Advanced” tab.

- Subsequently, in the “Security” tab, uncheck these- “check for publishers revocation” and “check for server certificate revocation”, and hit OK.

- Now, restart the system and try to send payroll data.

Method 4: Restore The Browser’s Advanced Settings

- First, close the QB application.

- Next, move to the “Tools” section in the IE browser and select “Internet Options”

- Then, under the “Advanced” tab, click on “Restore Advanced Settings”

- After that, checkmark the “Use TLS 1.0” and uncheck the “Use TLS 1.1 and Use TLS 1.2”

- Followed by this, exit the browser by clicking the “OK” key.

- Lastly, restart the system and send payroll data.

Wrapping It Up

After reaching this point, it is assumed that you have learned about QuickBooks Payroll Service. Here, we covered the basic definition of QB Payroll, its practical deployment, and the mechanism to fix payroll errors. Thus, it served its purpose of describing to you the basics of the QB Payroll facility. Meanwhile, you also have the option to connect with QuickBooks Desktop Payroll support. This way, you can get resolutions to your QB-related queries and its helpline number is 1-844-734-9204.

Frequently Asked Questions

Your organization’s payroll frequency depends on the organization’s payroll schedule. Businesses follow these schedules depending on their payroll requirements:

- Biweekly

- Semi-monthly

- Monthly

Yes, you can manage your payroll by using QuickBooks Payroll Service. This facility ensures accuracy with employee data, wage calculations, tax withholding, and timely payments.

The best way to run payroll involves the use of payroll software. Here, we recommend you go with QB Payroll due to its multi-structural payroll service facility.

Payroll data involves employee information, work hours, wages, deductions, taxes, and other benefits. The availability of these variables ensures accurate record-keeping, tax compliance, and timely payments to employees

Listed below are the steps to print payroll checks in QuickBooks Online:

- First, go to the payroll menu of QB Online.

- Afterward, click on the “Employees” section and run payroll.

- Followed by this, click on the “Print Paychecks” option.

- Then, choose the desired checks.

- Finally, print them for your records.

You can set up Payroll in QB Online in the following steps:

- First, move to QB Online’s “Payroll” menu.

- Afterward, select the “Employees” section and then the “Get Started with Payroll” option.

- Next, follow the on-screen prompts to submit the desired details.

- Finally, click “OK” to set up payroll in QB Online.