How to fix if QuickBooks payroll isn’t calculating payroll tax?

Today, most businesses rely on QuickBooks payroll for all their tax-related operations. This accounting software makes your tax tasks easy. But, any kind of issue in this QuickBooks online payroll program can cause tax calculation issues. Sometimes, QuickBooks payroll might not take out taxes due to some reasons. You can face this error if the payroll tax tables are outdated. This situation can also occur if the annual salary of the employee is more than the salary limit. If the payroll is not calculating the tax, you need to implement a few fixes.

Table of Contents

ToggleHere we are sharing situations of payroll not taking out the taxes and their solutions. Just in case you are not able to fix the error, you can reach out to us for quick technical assistance. Give us a call at our helpline number and get assistance directly from the support team.

QuickBooks Payroll is Not Calculating Taxes Error – How to Fix It

Tax calculation is an important part of QuickBooks Payroll software. This helps a business in managing taxes. But what if this software is not taking out the taxes? Well, there are solutions that you can try if the isn’t calculating payroll tax. Conditions depend on which you should implement solutions. Let’s read out these solutions and the conditions when you can try them to fix the tex-related issues.

Method 1: You can try this solution when the tax information of the employee is incorrect. This solution will also be useful if the year-to-date and quarter-to-date wage is incorrect. In this kind of situation, you’ll have to try these solutions.

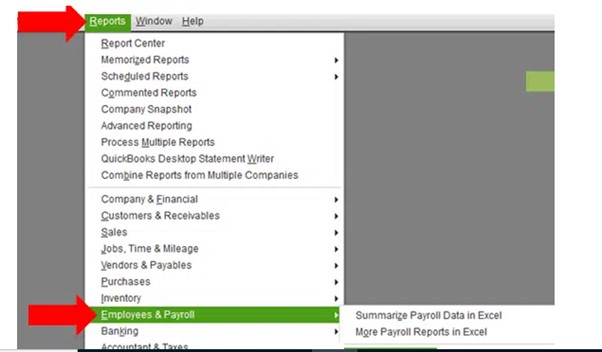

- At first, you are needed to select “reports”

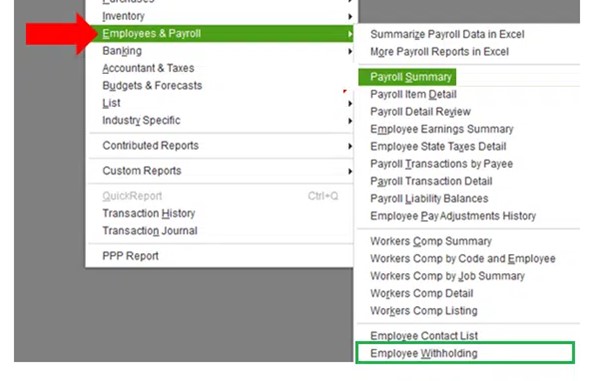

- After that, shift to the option of “employees and payroll”

- In this step, you now need to click on employee withholding

- Further, tap on the “Customise Report” tab

- After that, go for the columns section as per your requirements

- In the next step, click on the items that you want to display on the report. You can do this from the display list section.

- Once you’re done with this, make sure to choose the ok tab. This will save the changes that you have made in the report.

- Also, you need to check if your employees are set up accurately. Check this for all the options- state, local, and federal taxes.

- Now, you need to double-click the employee’s name to edit the employee. You can do this from the info window

- After doing this, you’ll get the employee information window on the screen.

- Make sure to click the payroll info.

- After this, you’ll have to tap on the “taxes” in the QuickBooks Payroll.

- The next step is to click on the option of federal, state, and other tabs.

- Last but not least, you will have to make sure that the employee is marked properly for taxes in the accounting software

Method 2: Another solution that you can try is when the annual limit has been reached. In the QuickBooks online payroll, there are chances of check marking of default limit and annual limit box. If this happens, there will be an issue in the calculation of tax. If this happens, the software will stop calculating on a paycheck. In such a situation, you can implement this general troubleshooting solution.

- Open the QuickBooks Payroll to start the process

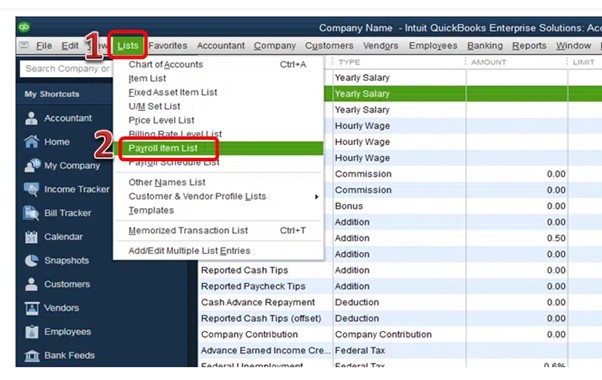

- At first, you need to select lists and payroll item lists. You can do this from the top menu bar.

- In the next step, you need to right-click the payroll item that you want to change. Further, choose edit payroll items.

- Scroll down to the next screen till you reach the limit type screen.

- After doing this, you’ll have to verify that the box present at the bottom is correct. You need to check whether it’s correct or not.

- If the limit is correct, the employee’s payroll will stop calculating at that limit.

- Now, you can update the amount

- Go to limit type where you will have to verify that you have chosen the right option.

- In case of Annual – set restart every year. For Monthly – Restart every month

- In addition to this, you can also change the default limit. Do this by limiting the type selection according to the requirements.

- In the last step, you just need to finish the process by tapping on the finish tab.

Method 3: If you’re having a new QuickBooks payroll subscription then you can try the given steps of the solution. In this solution, you can save the paycheck of the employee as per the calculations that you made earlier.

- In the QuickBooks update, you need to check the details of the employee to ensure accurate tax calculations.

- After this, you should enter both the withholding and employer matches in QuickBooks payroll software manually.

- If you have subscribed to the assisted version of payroll, you might face issues. These issues can be because of the payroll taxes that are being filed by Intuit.

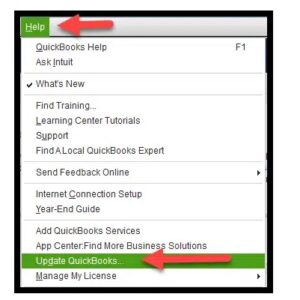

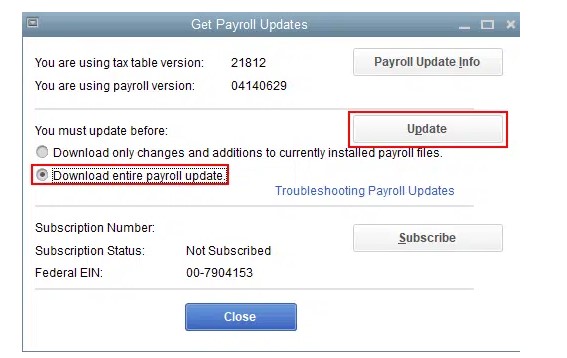

- In the next step, you need to update QuickBooks to the latest version as per your requirement.

- With this, you’ll be able to sync the software with the latest payroll forms and tax tables.

- Before running the payroll, you need to check if the payroll items and employees have been set up properly.

Summing up

So, that’s it. If QuickBooks payroll does not take out taxes, you can easily tackle it with given solutions. Depending on the different situations, you can apply the solutions to fix the tax-related issues in the payroll. In case you still need any sort of technical assistance for solving QuickBooks issues, think of connecting with us. We will provide you with instant and effective solutions to all your QuickBooks payroll troubles. Simply contact our team via live chat or helpline number.