How To Turn Off Manual or Automated Sales Tax In QuickBooks Online?

QuickBooks Online has some great features that provide comprehensive accounting solutions. One of the features of this accounting program is manual and automated sales tax. Sometimes, users mistakenly turn the sales tax on this software. Thankfully there’s an option of turning it off.

Table of Contents

ToggleYou need to turn off the sales tax if you don’t charge sales tax in QuickBooks Online. It is necessary to turn it off it has been set on. Before using any new invoices experience, you should do this. With the help of this, it becomes easy for an organization to set up the account for a seamless experience. You can do this in two ways which include turning off the manual or automated sales tax.

Here, we have discussed the way that can help in turning off sales tax. Users can also get help with the process of turning off sales tax in QuickBooks online from technical experts.

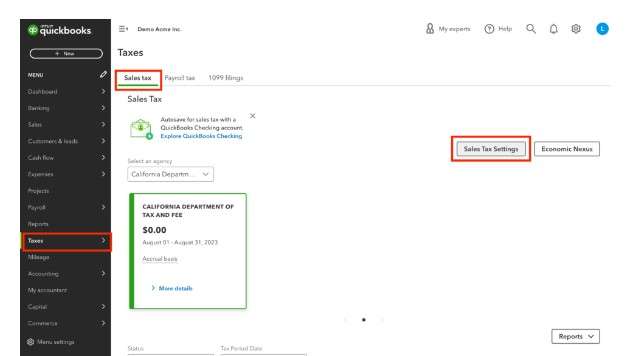

Turning off automated sales tax in QuickBooks Online

If you’ve turned on sales tax in your QuickBooks Online account but not using it then you can turn it off.

- The first thing that you need to do is to navigate to the taxes tab

- Next, choose sales tax

- Once you’re done doing this, look for the sales tax settings option

- After this, you need to opt for the turn off sales tax.

- Finally, user needs to choose “yes” to confirm.

Turn off manual sales tax in QuickBooks Online

Users can also turn off the sales tax in QuickBooks Online in a manual sales tax experience. The steps of manual ones will be different from the automated sales tax in QuickBooks Online.

- At first, you’ll need to go to the taxes tab

- Now, choose for sales tax.

- Here, you can now see the option of new sales tax experience. On this page, you need to choose “do it later” tab.

- After this step, you’ll have to tap on the edit sales tax settings which you’ll find under the tax menu.

- On the next page, you’ll be asked- Do you charge sales tax? Here, you need to pick the option that says No option. This is for the case when you don’t charge sales tax.

- Finally, you need to click on the save tab to confirm the turn-off sales tax process.

How to delete sales tax rates and agencies in QuickBooks Online

Many users who are new to QuickBooks online always get confused about the deletion of sales tax rates. But, deletion of sales tax rates is not possible in QuickBooks online. Similarly, you cannot delete tax agencies.

The good thing is that you can deactivate the tax rate in case you don’t use them. Also, you can only rename the tax agency and can’t delete it.

Deactivation of a tax rate in QuickBooks Online

- To start the deactivation process of a tax rate, you will first have to go to taxes.

- In the next step, choose sales tax

- After this, you’ll have to go to the related tasks section. You’ll find this section under the sales tax center.

- After this, you’ll have to choose the option of “add/edit” tax rates and agencies.

- In this section, you need to select a tax rate name

- After this, you just have to select for deactivate option.

- Finally, click on the “Continue” tab.

Renaming a tax agency

As you cannot delete the tax agency, you’ll have to rename it. We have discussed some important steps that will help in renaming the tax agency.

- First of all, you need to move to the taxes tab.

- Under the tax section, choose the option of sales tax.

- In the next step, you are needed to the agency name table which you’ll find in the sales tax center.

- Now, you need to choose to rename the agency name that you want to edit

- The final step is to make a change and then save it.

How to record sales tax payments in QuickBooks online?

Users can keep the sales tax information updated in QuickBooks. However, QuickBooks users always ask -how to record sales tax payments in QuickBooks online. This accounting software allows you to record the tax payment manually.

For this, you’ll first have to go to Taxes and then select ‘Sales tax’. After this, simply find the return that you’ve filed. The next step is to tap on ‘View Tax Return’.

You are also needed to select a filing method, and then choose the Record payment. For this, the user will be asked to add payment details such as Bank account, tax amount, and payment date.

After following these steps, choose “Record payment”. You must finish the payment recording process by selecting ‘Back to sales tax center’.

What to do if unable to turn off sales tax in QuickBooks Online?

If for any reason you’re not able to turn off the sales, you can then manually edit the invoices. Users can also choose a 0% tax rate for removing the automated taxes. Also, you can create a custom rate for calculating the sales tax and creating invoices.

- User needs to move to the tax’s menu

- Open the sales tax settings

- In the next step, click on add rate which you’ll find under the custom rates section.

- You now need to tap on the single or combined

- Make sure to enter the name of the custom rate. Also, choose the agency and enter the rate. Finally, press save.

You can use the rate for creating invoices. For this, open the invoices and then select the tax rate section. In the next step, tap on the drop-down and then select 0%. After entering all the details, you’ll have to click on save and close.

Summing up

Turning off sales tax can be done with ease in QuickBooks Online. You can do this in manual and automated sales tax. If you are stuck at any point while following the above-mentioned steps then we recommend you get assistance from the technical support team.